In this article

Another end of quarter means a new industry result round-up! As usual, we’ve looked at hundreds of sites across London and the southeast of the UK to get a view of how the industry has been faring these last few months.

We look at a range of different business types including casual and fine dining restaurants, quick service, bars and cafes.

Our last round-up – Q4 2023 – saw a 5.7% increase in sales versus Q4 2022 led by a strong December performance (11.2% increase in like-for-like sales). The number of transactions remained pretty flat year-over-year, which meant the sales increase was mostly due to increased prices after a year of fighting against high inflation.

This quarter saw results flatten out slightly after 6 months of lower inflation and prices finally catching up.

This quarter’s results

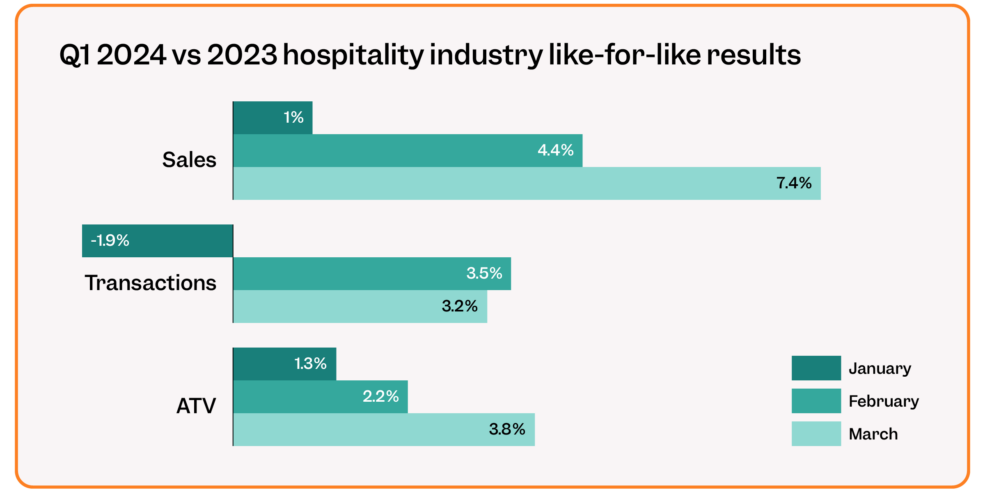

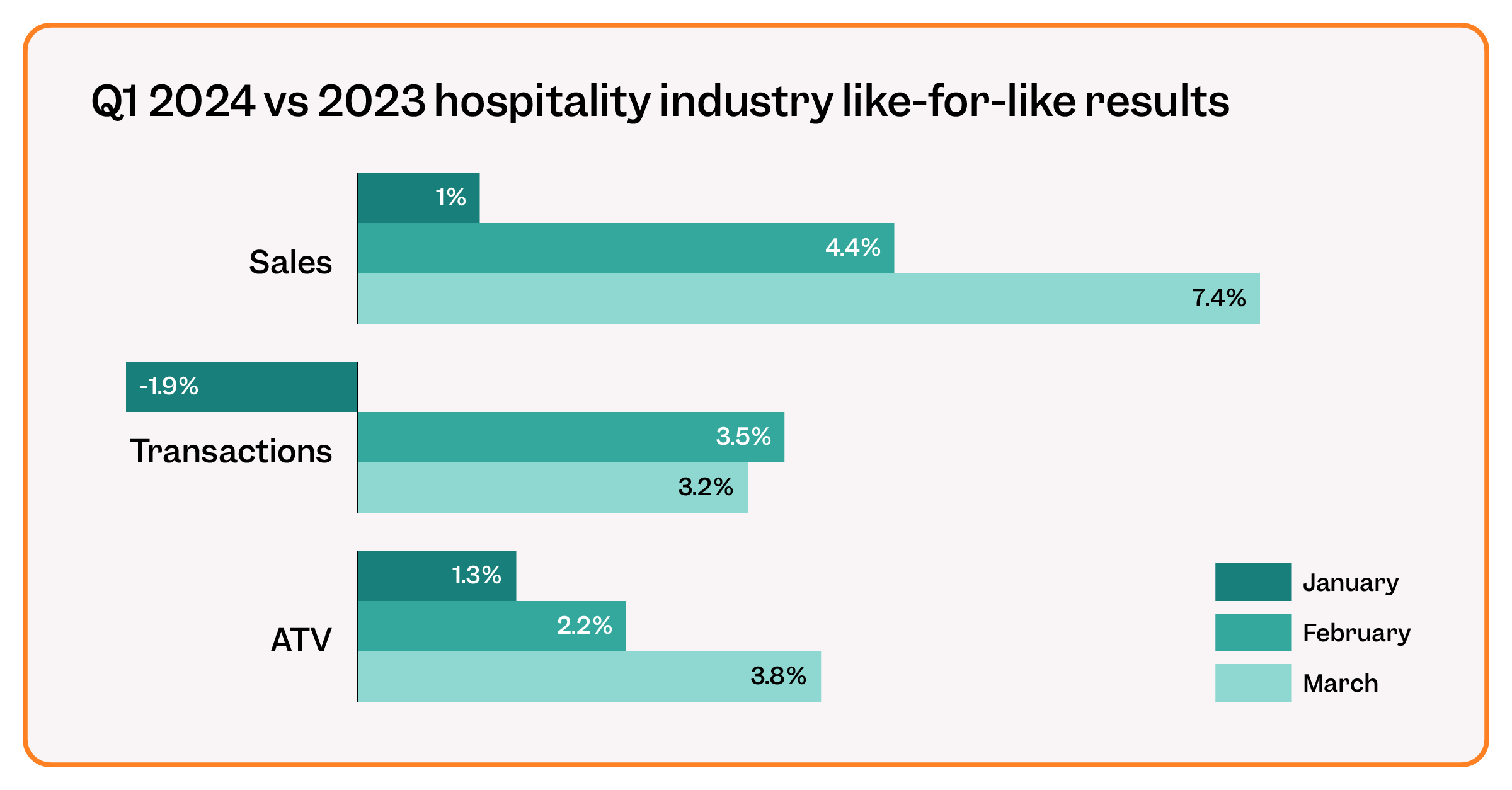

January was by far the worst month of Q1. Sales were only up 1% and transactions were down almost 2%. With inflation at 4%, this was clearly not ideal. January is traditionally a bad month for hospitality, but the cost of living squeeze after Christmas mixed with Dry January meant that the industry suffered.

However, February brought a small ray of hope where like-for-like sales results (4.4%) actually exceeded inflation (3.4%). We saw increased transactions as well with the one caveat being that there was an extra day to account for this year. Valentine’s Day performed much better than last year: transactions were up 5.2% and sales increased by 11.2% versus Valentine’s Day 2023.

Finally, March’s results mirror December’s as the holiday at the end of the month pushed sales 7.4% higher than last year. Easter falling in March meant businesses were able to close the quarter off strong, but might mean a leaner April than we’ve been used to for the last couple of years.

With sales continuing to increase at a faster rate than transactions, prices continue to be tinkered with to help those margins. With the recent news that the price of a cup of coffee has increased by 30% between 2021 and the start of 2024, going out to eat is becoming more and more of a luxury. According to Tom Kerridge, speaking on The Rest is Money podcast, it’s the mid-market businesses that are feeling the strain as consumers decide to go out somewhere special on special occasions more than treating themselves more regularly at more casual establishments.

Easter 2024 vs Easter 2023 results

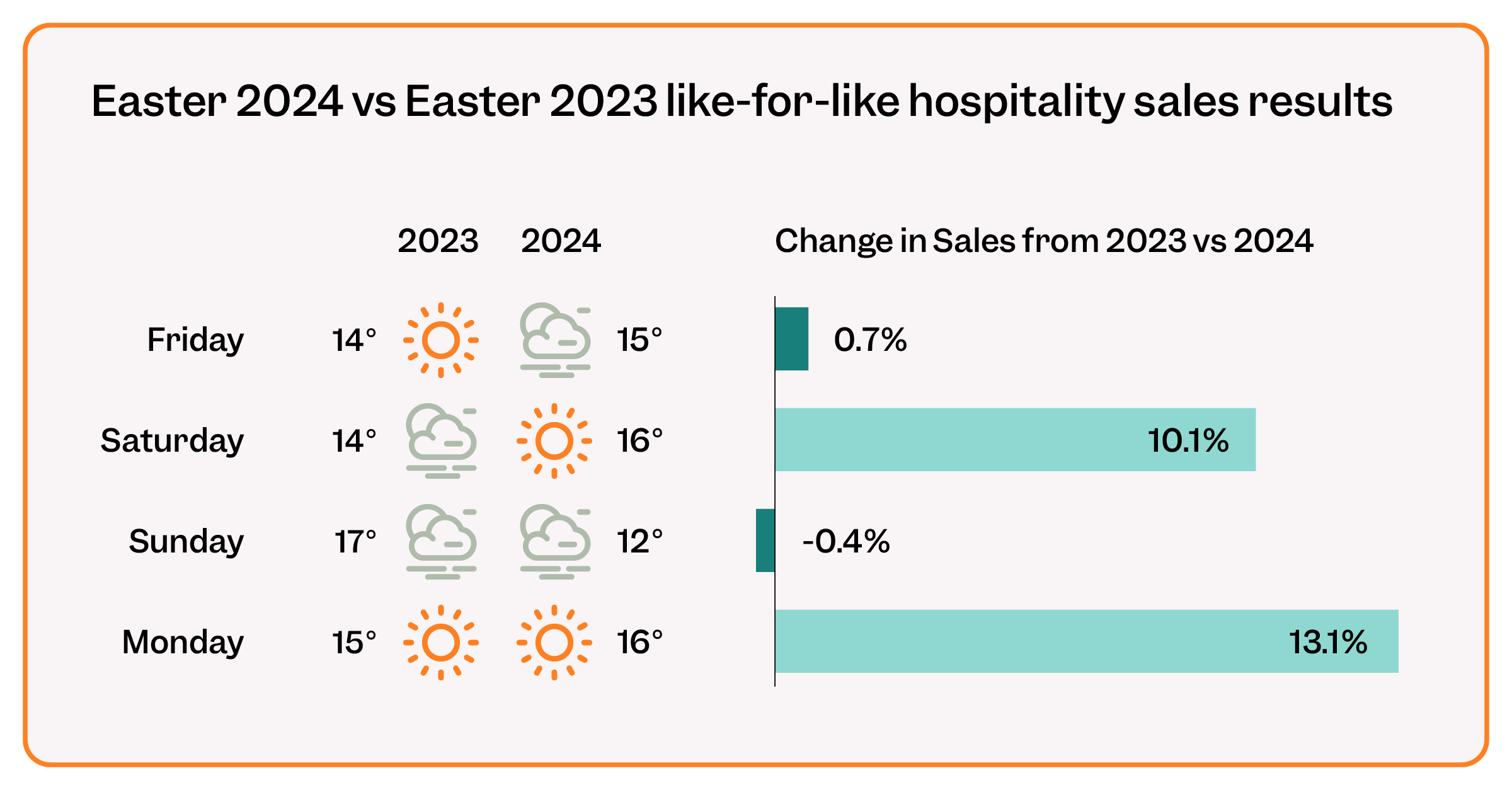

The Easter Bank Holiday weekend fell in March for the first time since 2018 this year which meant for an exciting way to close the quarter. Compared to last Easter, sales were up 6% across the 4-day weekend, driven mostly by a successful Saturday and Monday.

We love a Bank Holiday here in the UK, but there’s nothing better than a sunny and (slightly) warm one. On the days when the weather was better than last year’s, we saw a 10.1% and 13.1% increase in sales versus a 0.7% increase and a 0.4% decrease when the weather was worse. It just shows how much impact weather can have on demand.

If you’re interested in seeing how weather can impact your own demand, then get in touch to check out Tenzo’s forecasting module which takes holidays, weather, historical sales and more into account.

Things to think about in Q2

Where do these results leave us when looking forward to Q2? As inflation continues to stabilise, the consistent increase in like-for-sales will be reassuring, but unfortunately, costs are also increasing. The National Living Wage has now gone up which will have a big impact on already tight margins.

Businesses will also need to consider the tipping legislation coming into effect in July. We’re already seeing some innovations come out of that. See, for example, Tenzo user Ping Pong’s brand charge that’s recently made the news.

We also seem to be embarking on a new phase of train strikes, the first of which is set to go from Friday, April 5th to Monday, April 8th. According to UKHospitality, this set of strikes is estimated to cost the industry £387m. As a silver lining, Tenzo’s research has at least shown that train strikes over the weekend have less of an impact than they do on weekdays with sales dropping around 11% on strike weekends instead of around 27% on weekdays compared to the previous week.

Conclusion

The first quarter of the year started on a concerning note, but the last two months have looked much more positive. We’ll have to wait and see if this positivity continues into Q2 to help tackle the headwinds of ever-increasing costs.

Keep up with monthly industry results on Tenzo’s Linkedin page and stay updated!