In this article

2023 has come to a close and with that, it’s time to take a look back at how the restaurant industry fared in its final few months.

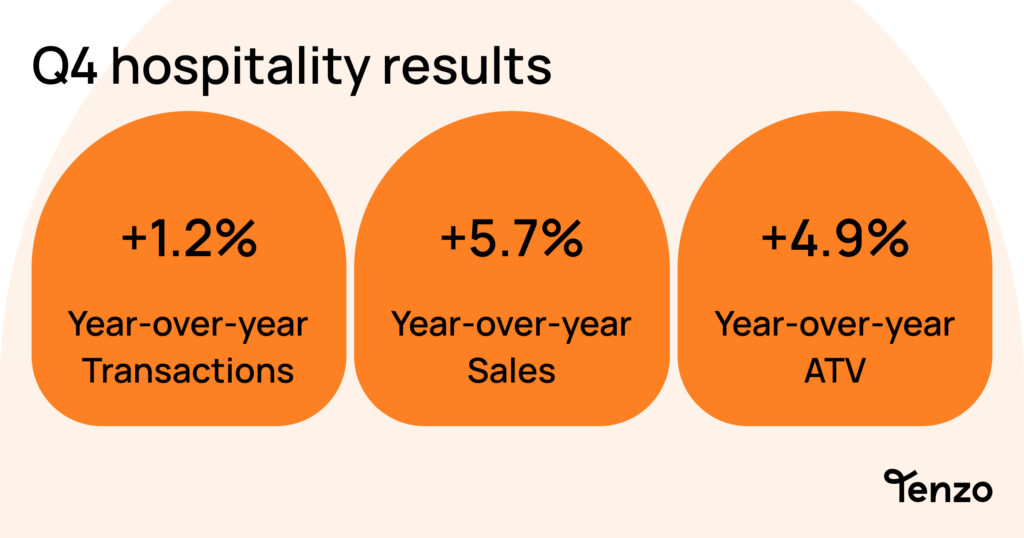

As usual, we analysed sales, transactions and average transaction value (ATV) at hundreds of sites in the South-East of England to see what restaurant performance looked like across the industry.

We publish these reports every quarter (and monthly on Linkedin!) so take a look at Q2 and Q3 industry reports on the blog!

Here’s what Q4 2023 had in store.

Q4 as a whole

Q4 2023 saw the trend we’ve been reporting across the year continue: transactions remained mostly flat, but sales increased.

As inflation rose drastically over the last year, restaurant prices couldn’t increase at the same pace, but now that inflation has somewhat stabilised (currently at 3.9%) prices have finally been able to catch up.

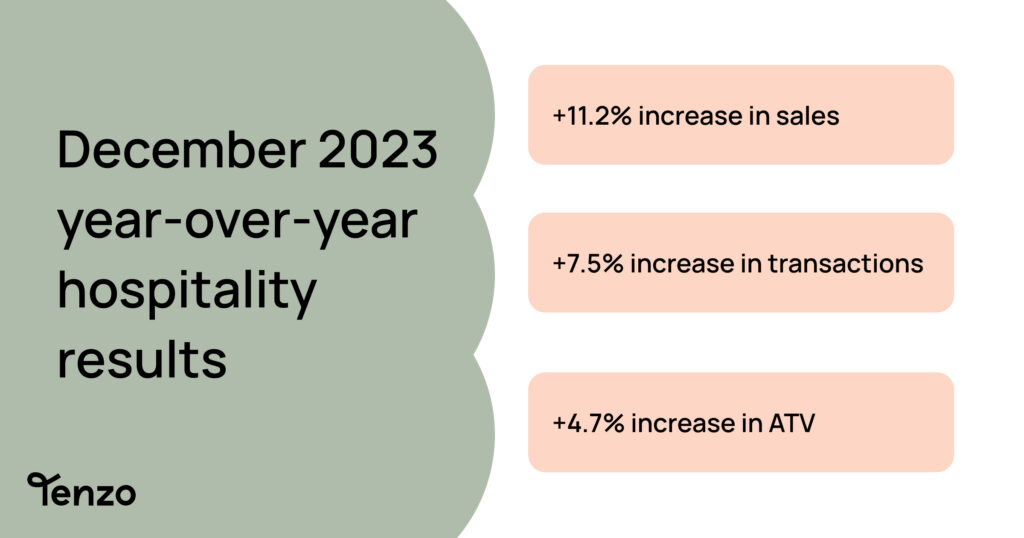

The positive quarterly results were mostly driven by the month of December.

The impact of a strong December

When we break it down by month, December was the highest performing with an average increase of 11.2% in sales and a 7.5% increase in transactions.

While this is positive news from the industry, it’s important to note that December 2022 saw three train strikes which had a heavy impact on sales that month. In fact at the Casual Dining Show, Dishoom MD Brian Trollip said they lost 3,000 reservations due to the strikes that month, the first December in three years not affected by Covid. 2023 only saw one strike not affecting the full network, so had less of an impact.

For many businesses, performance in December needs to offset a quieter January and it remains to be seen if the bump in sales was enough. Costs will continue to increase in 2024 as we await 4 big events.

What to consider going into 2024

It’s going to be a big year for hospitality businesses thanks to a lot of changing legislation:

- Employment (Allocation of Tips) Act 2023

The new tipping legislation comes into effect in 2024 meaning that all businesses will need to look at how they use their ‘service charge’. Under the new law 100% of tips must be distributed to employees and employers will no longer be able to deduct operating costs (eg credit card processing fees or tronc operating costs).

- National Living Wage

The National Living Wage is set to increase to £11.44 per hour in April 2024. This is over a pound more than the current minimum wage. Hospitality businesses will need to therefore increase hourly wages while also rethinking the current tronc system.

We’ll also be waiting for a few big political moments in 2024:

- The Spring Budget

Likely the last budget before the election, the government will once again have some budget to play with. In the Autumn Statement, we saw National Insurance Contributions cut from 12% to 10%, so we may expect similar tax-cutting, but will it affect individuals or businesses?

- General Election

We are now officially due for an election. It looks like this will be in the autumn, so as the major parties gear up to campaign, keeping an eye on plans for hospitality will be key if a new party comes to power.

Conclusion

It was an interesting Q4. Inflation finally looks to be under control so restaurant sales numbers were not as inflated as in previous quarters. Could single-digit increases in line with inflation be the new normal? After years of uncertainty, it might be what the industry needs.

Planned costs are going to go up this year so this will have an impact and businesses need to be ready to handle them. However, unlike the past few years at least these increases can be planned and budgeted for.

We will continue to report on these industry trends throughout the year, so sign up to our newsletter and follow us on Linkedin to stay up to date!