In this article

At Tenzo, we’re in the business of data – we live and breathe it. We make sure that our customers have the data they need to make the best possible decisions to supercharge their performance. Because of this, we have access to a huge amount of industry data that shows how hospitality as a whole has been performing.

As Q2 comes to a close, we have pulled sales data from hundreds of restaurants in the South-East of the UK to see how the last 3 months have been for hospitality compared to last year.

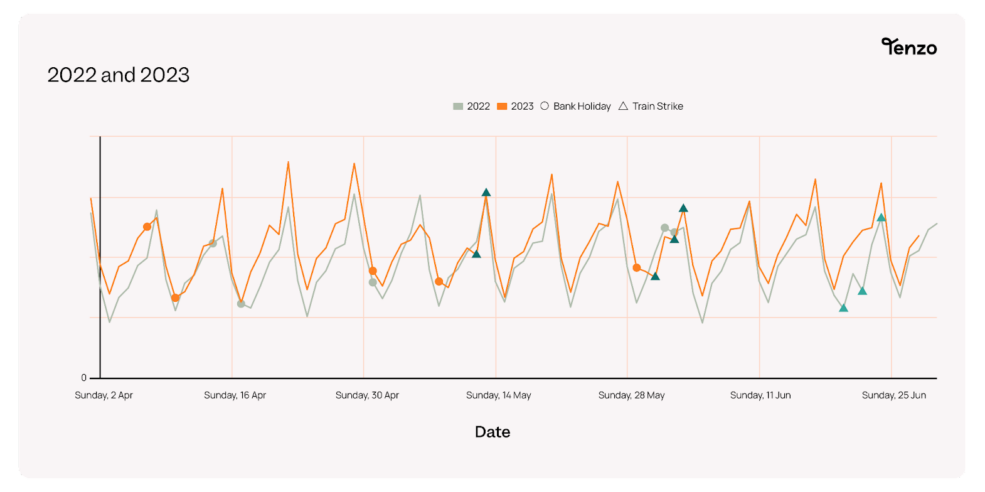

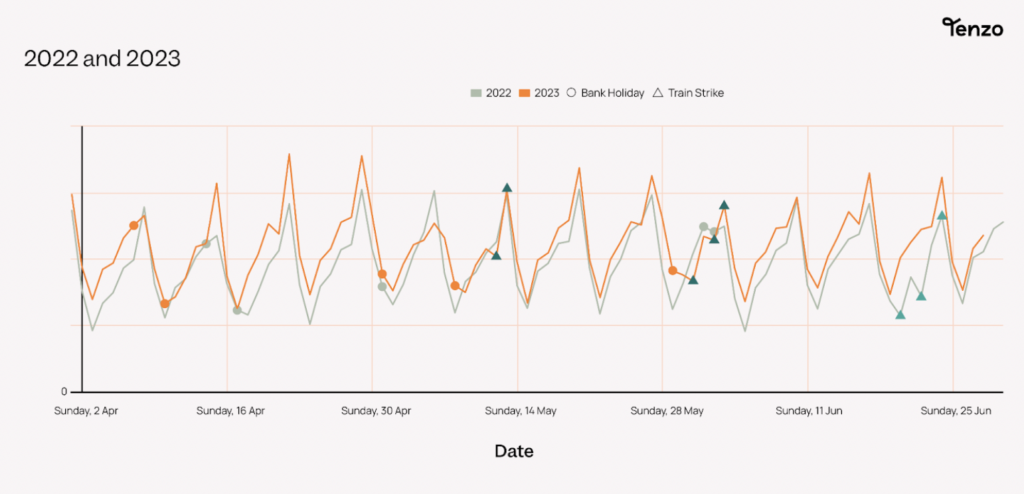

It’s particularly interesting to look at these quarters because of the multitude of Bank holidays, national celebrations and train strikes that occurred throughout and how these outside forces meaningfully impact sales. The graph below shows the quarter at a glance.

(We’re looking at like-for-like days so Monday, June 26th 2023 vs Monday, June 27th 2022 to get the most accurate view of trends. The dates below correspond to 2023’s calendar.)

So here’s a breakdown of the trends we’ve seen in Q2 2023 and how they compare to last year.

Overall sales

At first glance, it does appear that sales are increasing year-on-year – this year’s trend line is consistently above last year’s. However, due to rising inflation and energy price hikes, most businesses have increased their prices. In fact, on average prices have risen by 11% so it would be very surprising if we didn’t see an increase year-over-year in sales numbers.

However, the average increase in sales appears to be 16% so, accounting for the price rises, it looks like sales have increased by 5% since last year. Some good news!

Easter

The first of the many Bank holidays we get in Q2 (at least in 2022 and 2023) is Easter. The shape of the graph remains consistent year-on-year when you consider Easter fell on April 17th in 2022 and April 9th in 2023. We see that sales are slightly increased on Good Friday (vs a non-holiday) as people take advantage of the long weekend. However, the Saturday spike in sales is much lower than average as people go home to visit family or take advantage of the time off to travel.

Bank holidays

We had 3 Bank holidays in May 2023 much to everyone’s delight. But, what did this mean for restaurant sales?

If we look at the first of the three, May Day (May 1st 2023 and May 2nd 2022) we can see what a typical bank holiday looks like – the same pattern repeated in 2022 and 2023. Sales are pulled up not only across the weekend but also on the previous Thursday, showing people like to get the party started early. The Saturday’s peak sales stay in line with other Saturdays, but sales on Sunday and Monday are significantly higher than on non-bank holiday weekends.

We see the same trend in the final bank holiday in May 2023: the spring bank holiday (May 29th 2023) Sales across the end of the week and weekend are higher than they would be in a non-bank holiday week.

Where things start to get interesting is during the other bank holidays that occurred in 2022 and 2023…

National celebrations

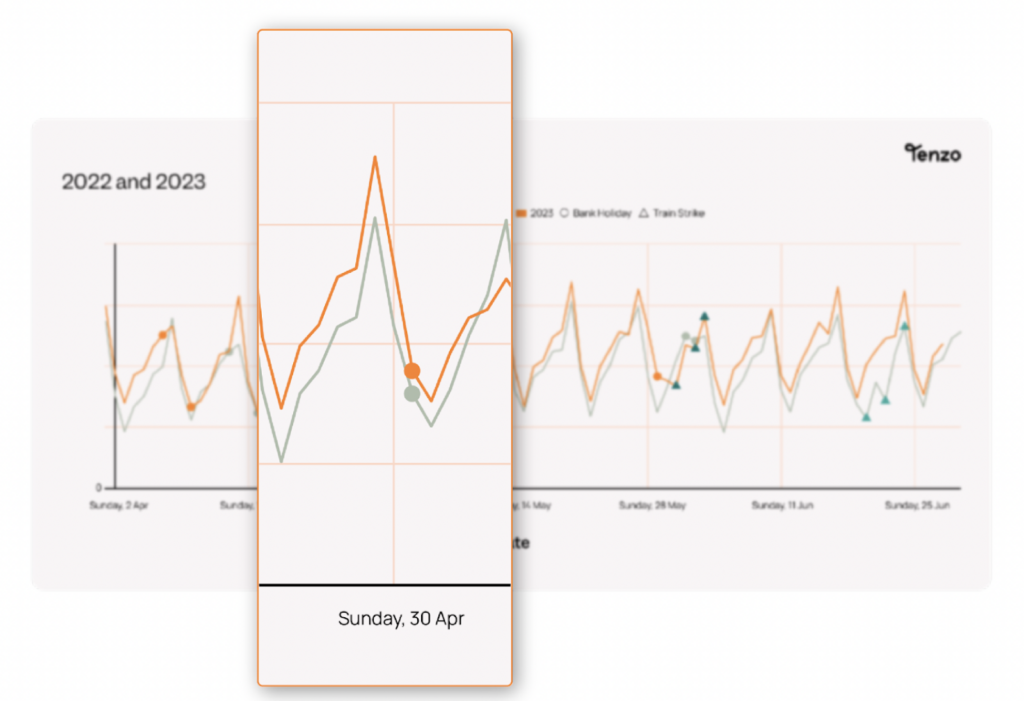

By coincidence, we had two national celebrations in May 2022 and 2023: the Queen’s Platinum Jubilee and the King’s Coronation.

These are occasions when the whole country celebrates, so you might have expected hospitality sales to increase during these times. However, this is not the case.

The humble street party replaces a lot of hospitality activities. We saw average sales drop significantly during both the Jubilee and the Coronation so that Saturday spike never occurred. In 2022, there was the added confusion of having a Thursday and Friday (the 2nd and 3rd of June 2022) as holidays rather than the Monday, so by the time Monday rolled around, people were tired of celebrating and the Monday sales were the lowest we saw all quarter.

Charles’s coronation (Saturday, May 6th through Monday, May 8th) giving us the Monday off at least meant that restaurants were able to benefit from higher-than-average Monday sales.

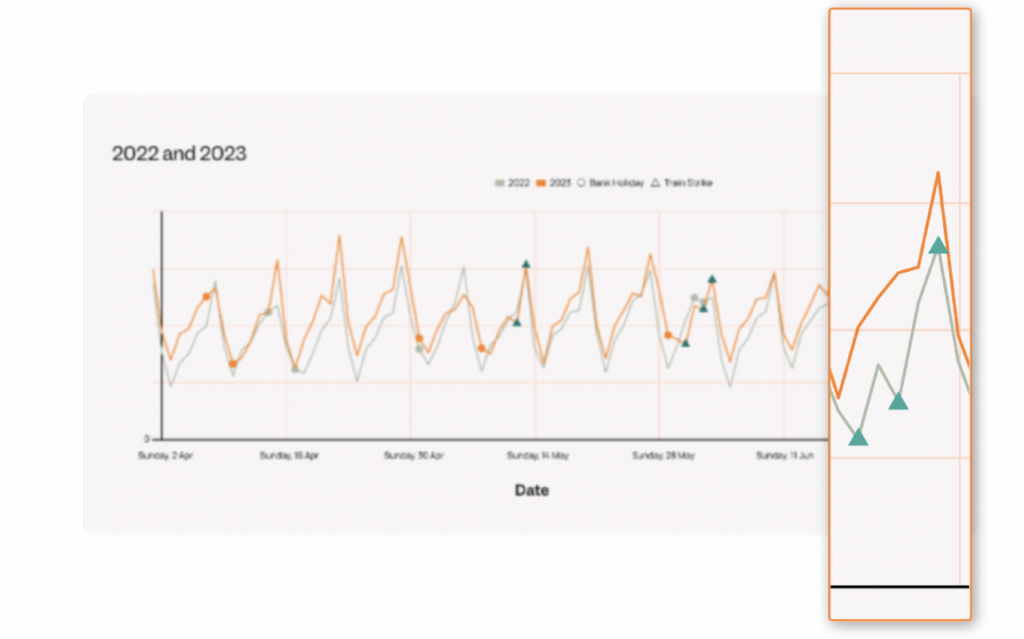

Train strikes

Believe it or not, the first set of train strikes took place during Q2 2022. Unsurprisingly, when both the tubes and the trains were out of action sales took quite a hit. On the first day of strikes in 2022 (Tuesday, June 21st), sales were down 36% compared to what they had been on the previous Tuesday.

We have continued to see that same pattern with the latest strikes, although the effects have lightened over the past year. On Friday, May 12th 2023, sales were down 11% compared to the previous Friday. Where we see the most impact is on weekdays. On Wednesday, May 31st 2023, a strike day, sales were down 26% compared to the previous Wednesday.

Conclusion

Despite the never-ending rises in costs for everyone, the second quarter of 2023 still saw an upward trend in sales. The real issue is lack of consistency: with so many external factors affecting sales (bank holidays, strikes, etc) it was difficult to understand what to expect. What we can see here though is that patterns emerge and if you keep track of these trends year-on-year, you can have a good idea of what’s to come.