At Tenzo, we’re all about turning restaurant data into actionable insights. Each month, we dig into like-for-like restaurant sales trends in the UK to understand how trading conditions are shifting and what that means for operators.

This quarter, our data from London and the South-East paints a picture of a strong summer, buoyed by July’s sunshine and an August Bank Holiday boost, before Tube strikes brought the usual chaos in September.

July: Strong Start to the Quarter

July kicked things off on a high note. Like-for-like sales were up 7.6%, with transactions rising 2.9% and average transaction value (ATV) climbing 2.8%. Warm weather and the start of the summer holidays gave restaurants a welcome boost. A good reminder of just how powerful seasonal moments can be for driving footfall and spend.

August: A Softer Month with a Bank Holiday Boost

August saw growth ease slightly, with sales up 4.4% and transactions almost flat (+0.2%). However, customers continued to spend more per visit, as pricing fights to keep pace with ever-increasing costs, with ATV increasing 3.4%.

The August Bank Holiday weekend delivered one of the summer’s strongest performances: sales were up 9.% compared to the same weekend in 2024, and 5.2% higher than the weekend before. For many operators, it was a bright spot in an otherwise steady month, proof that well-timed promotions and events can still draw diners out in numbers.

September: Tube Strikes Shake the Capital

September told a different story, particularly for London. Overall, sales rose 2.9%, again driven more by higher ATV than increased transactions. But when the Tube strikes hit (7–11 September), the impact was clear.

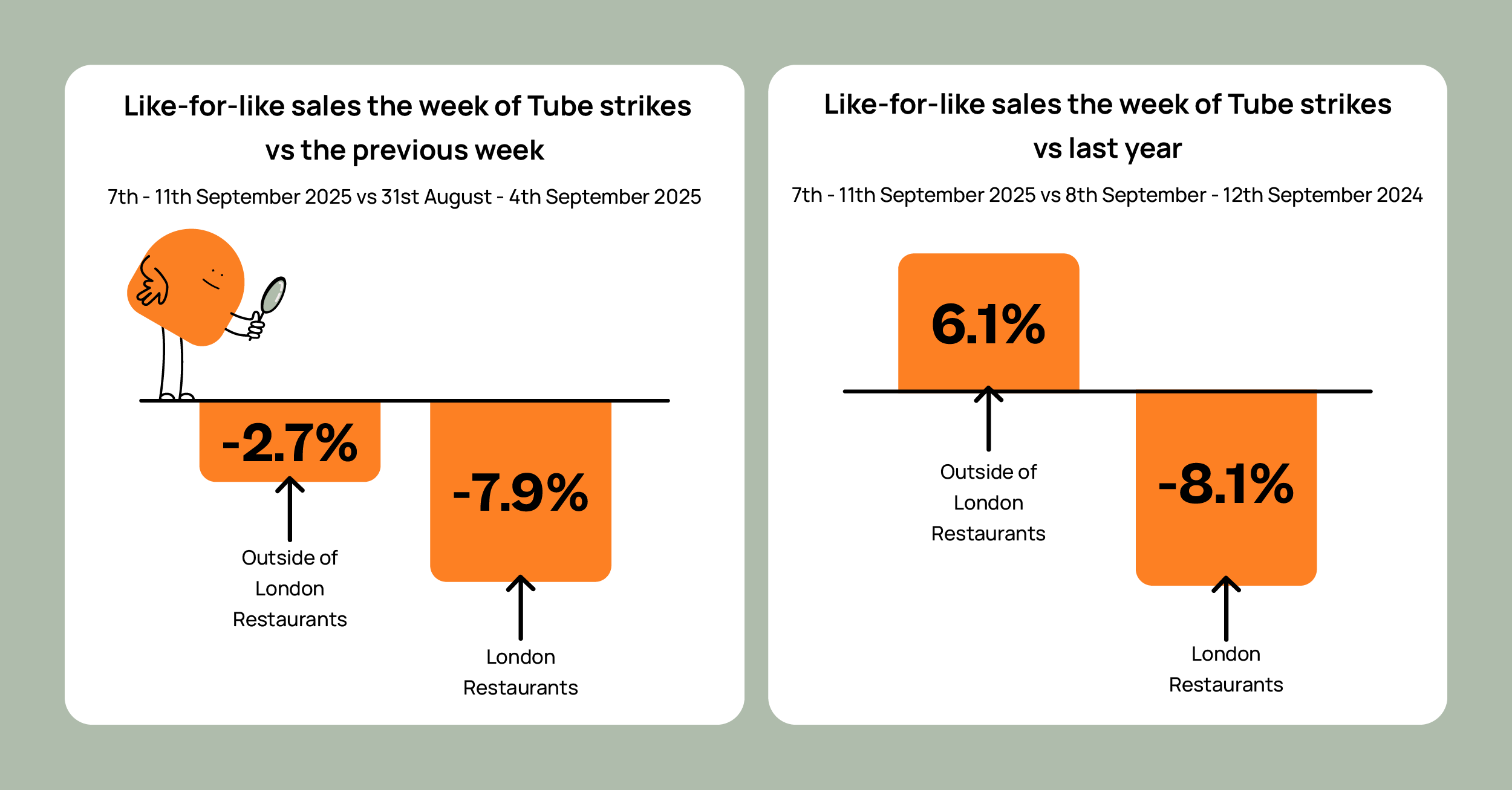

- London restaurant sales dropped 7.9% week-on-week and were 8.1% down year-on-year.

- Outside London, restaurants proved far more resilient — just a 2.7% dip week-on-week and a 6.1% increase compared to last year.

The contrast highlights just how dependent central London venues remain on commuters and visitors, while suburban and regional restaurants continue to benefit from people choosing to dine closer to home.

The Quarter in Numbers

Across the quarter, restaurant like-for-like sales grew 5.2%: a solid result that reflects steady consumer demand despite economic headwinds and local disruptions. July’s strength carried the quarter, while August and September held steady.

What This Means for Operators

Q3 restaurant sales showed resilience across the board. Guests might be dining out slightly less often, but they’re spending more when they do. Big calendar moments like the August Bank Holiday continue to deliver strong results, while the impact of September’s Tube strikes underscores the importance of flexibility for city-based operators.

As we move into Q4, restaurants will be looking to capture early festive spending and maintain that ATV growth, and Tenzo will be tracking every data point along the way.